Global online transactions were valued at $5.2 trillion in 2020. Whether you are a freelancer or a business owner who sells online, you always need an online payment method to receive and send payments. Online payment gateways allow you to send or receive payments from anywhere in the world. It helps you to scale your business to the world and make more revenue.

Table of Contents

What is an Online Payment Gateway?

An online payment gateway is a way through which you can send and receive payments from people. Being an online mode, there is no limit to the location in this. You can easily send and receive payments in the countries where these payment providers offer their services.

You can use these payment gateways to receive payments from your customers, and individuals. If you have an online business, you can also use these methods as a payment method on your website using which your customers can buy your products and services.

Characteristics of a Good Payment Gateway

Each payment method has its own features and services. But, there are some common characteristics that every good payment provider should have. here, I have listed the key characteristics of a good payment provider:

- It should be available in the countries where you sell your services/products.

- t should support multiple currencies.

- It should be very secure.

- It should have low processing fees.

- Its payment process should not take too long. This should be 24 to 72 hours.

- Its support should be great so that if you ever run into a problem, they can help you out.

- It should be very easy to set up and use.

There are many online payment providers available that you can use. However, you’ll want to use the payment provider that best suits your business. In this post, I have listed the 8 best online payment gateways.

8 Best Online Payment Gateways For Freelancers

1. Paypal

PayPal allows individuals and businesses to send money using only their email addresses. Paypal was founded in 1998 by Max Levchin, Peter Thiel, Luke Nosek, Ken Howery, and Yu Pan. Currently, PayPal is being used by more than 270 million people in 200 countries. The best thing about Paypal that differentiates it from its other competitors is that you can do transactions securely in real-time. Paypal is so easy to use that you can sign up for free using just your email and start using it.

Country availability: It is available in 200 countries/regions.

Payment Processing time: It usually takes 24 to 72 hours.

Processing fees: Paypal charges roughly 3% to 6% based on the currency and payment type. You can read the full details here.

Currencies supported: It supports 25 currencies.

Payment limits: For the verified account there is no limit. For other accounts, you can send up to $60,000 but only $10,000 in a single transaction.

2. Payoneer

Payoneer is a leading payment service provider. It was founded in 2005 by Yuval Tal. It helps professionals and businesses to send and receive money globally as well as locally. Currently, more than 5 million people use it as their payment service. Payoneer offers various types of payment methods like ACH, bank debit, local bank transfer, and debit/credit card payment. Payoneer provides very easy and simple ways to use it on your website and e-commerce platform.

Country availability: It is available in 150 Countries.

Payment Processing time: Up to 24 Hours and sometimes up to 5 days.

Processing fees: Payoneer charges 0.5% of the amount you transfer.

Currencies supported: It supports 150 currencies.

Payment limits: There is no limit on receiving payments. You can transact $10,000/mo from account to account.

3. Stripe

Stripe is a leading payment service provider that allows businesses to collect payments from customers. The company was founded in 2010 by Patrick Collison and John Collison. It offers a lot of useful features like subscription, invoice generation, customized elements, prebuilt payment pages, and many more. Due to its wide variety of customizable features, it is used by many large enterprises such as Amazon, Apple, and Esty. Stripe is also certified as a PCI Level 1 service provider, which means you don’t have to worry about security.

Country availability: It is currently available in 47 countries for businesses.

Payment Processing time: Up to 3 working days.

Processing Fees: It charges roughly 2.7% + 5¢ per card transaction.

Currencies supported: It supports 135+ currencies.

Payment limits: Stripe doesn’t have a fixed payment limit. Their limits vary according to the type of business and payment.

4. Skrill

Skrill is one of the leading commerce and payment provider companies that was founded in 2001 by Benjamin Goldman as the initial name of Moneybookers. Lots of freelancers, professionals, e-commerce business owners, enterprises, and even individuals use Skrill to collect payments internationally. It supports various payment methods such as bank transfer, debit/credit cards, bitcoin, bitcoin cash, and Neteller. It offers both personal and business accounts that you can create as per your requirement. Creating an account on Skill is very easy and simple.

Country availability: It is available in 131 countries.

Payment Processing time: Up to 1 – 3 days depending on the Recipient’s bank.

Processing fees: It does not charge a fee for receiving funds. It charges between 0% to 5% for sending money depending on the type of transaction.

Currencies supported: It supports 40 currencies.

Payment limits: Its transaction limit varies depending on the type of transaction. You can read the full details here.

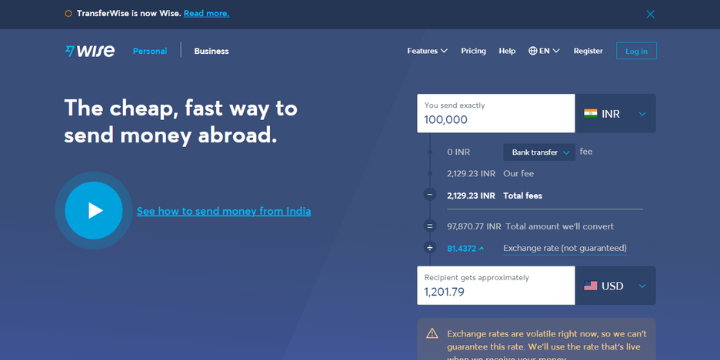

5. Wise

Wise is one of the best online payment providers. It allows individuals and businesses to send and receive money around the world. Wise allows you to send money to a Direct Back account and UPI ID. It provides you with the real-time value of currencies and shows you the converted value on the payment page. Creating an account on Wise is very easy and fast. To open a personal account, they only ask for your ID to verify your identity. For a business account, you will need to provide registered business information such as business name, business address, etc.

Country availability: It is available in more than 150 countries.

Payment Processing time: Upto 24 hours.

Processing fees: It charges a very low fixed price based on the region.

Currencies supported: You can keep 50+ currencies in your account.

Payment limits: Limits differ for personal and business accounts. However, there is no limit for all currencies other than USD. Personal accounts can transact up to 20,000,000 USD and business accounts can transact up to 30,000,000 USD per day. You can read about it here.

6. Authorize.net

Authorize.net is a subsidiary brand of the payments company Visa. This enables merchants to accept all of their customers’ payment options by offering multiple payment options, including credit cards and electronic checks. It primarily focuses on e-commerce merchants and enterprises. It is the fastest and most secure payment gateway available. It takes a while to set up, but the results are worth it. They have so many features it’s hard to list them all.

Country availability: It supports transactions from the United States, Australia, and Canada.

Payment Processing time: Upto 24 hours.

Processing fees: It charges a $25 monthly fee, 10¢/transation, and 10¢ daily batch fee.

Currencies supported: Although it supports multiple currencies, you can set only one currency for your account.

Payment limits: It doesn’t have a fixed limit.

7. Revolut

Revolut is a payment service provider and online banking company that allows you to send, receive and save money online. Currently, more than 25 million people use it for their personal use and more than 500K users use it for their business purpose. The company was founded in 20015 by Nikolay Storonsky. The process of creating an account on Revolut is very smooth and fast for both individuals and businesses. You can use bank transfers, debit/credit cards, and Apple Pay to deposit and send money.

Country availability: It is available in European Economic Area (EEA), Australia, Singapore, Switzerland, Japan, the United Kingdom, and the United States.

Payment Processing time: It takes 1 – 3 days to settle your payment.

Processing fees: It charges 2.5% for online payments, and 1.5% for offline payments using its card.

Currencies supported: It supports 14 currencies.

Payment limits: It has a limit depending on the number of payments. This is 2,000 payments per day and 5000 payments per week.

8. Bitpay

Bitpay is an excellent payment provider company that allows you to accept payments using bitcoin on your website. This payment company was founded in 2011 by Stephen Payer and Tony Gallippi. Creating an account, setting up, and integrating is very easy as it does not require any special coding knowledge. They have a very unique transaction system that helps merchants accept funds without worrying about chargebacks or fraud. It offers a wide range of payment methods for customers.

Country availability: It is available in nearly 230 countries.

Payment Processing time: Up to 2 working days.

Processing fees: It charges 1% for each transaction.

Currencies supported: It supports 8 cryptocurrencies and 5 USD-pegged stablecoins. Here you can read about it.

Payment limits: It doesn’t have any limit.

Benefits of Online Payment Gateway

- This gives you the ability to expand your business to more locations.

- It reduces the risk of payment fraud.

- Your customers can pay you at any time using online payments.

- It provides a variety of payment facilities to your customers such as payment through debit/credit cards, UPI, PayPal, EMI, and many more.

- It allows you to collect the payment directly to your bank account.

- Online payment is very easy and fast.

Wrapping Up

Every business has its own unique requirements. One of them is payment service provider. It may be that one business needs a payment service available in as many countries as possible and another business needs a payment service that supports cryptocurrencies. Before choosing any payment service, you should analyze your needs properly.

I have listed all the best payment providers here, in which I have also told which payment provider is available in how many countries, how many currencies it supports, how much time it takes for processing, and other important things. You can choose any payment method as per your requirement from this list of online payment methods.

Read Also: 7 Best WooCommerce Hosting Providers